Coronavirus (COVID-19): Latest advice & guidance for brewers

As this is a rapidly evolving situation all questions and feedback should be sent to political@siba.co.uk and we will do our best to respond. This page is correct as of 16th July 2021

SIBA Actions & Updates

16 July – SIBA Updated Covid-19 Guidance – link

23 April – SIBA’s latest update – link

16 April – SIBA’s latest update – link

9 April – Friday’s email – link

1 April – latest update – link

26 March – Friday’s email – link

19 March – Friday’s email – link

16 March – SIBA responds to Scotland reopening plan – link

12 March – Friday’s email – link

5 March- Friday’s email – link

3 March – SIBA responds to the Budget – link

26 February – Friday email – link

19 February – SIBA’s latest Friday update – link

12 February – Friday’s email – link

12 February – SIBA’s latest survey results

5 February – Friday email – link

29 January – Friday’s email – link

27 January – Scotland announce new Brewers Support Fund – link

22 January – Friday email – link

15 January – SIBA update – link

8 January – SIBA update – link

5 January – SIBA responds to the new lockdown – link

18 December: SIBA’s latest email – link

11 December: SIBA Friday email – link

4 December: SIBA Friday email – link

Please note: This page has been edited to only show the most recent updates. To view all updates regarding COVID-19 please visit the SIBA COVID-19 archive page.

Sign up for updates

Not a member of SIBA but want to receive email updates from us regarding the Covid-19 pandemic and the options, advice and support open to brewers? Sign up to our regular Covid-19 Industry Alerts by clicking here

Critical worker

The Government has clarified those eligible for critical worker status and can therefore access in-person education for children. The letter from the Secretary of State confirms that those in the food sector, including those in the production, processing, distribution, sale and delivery of food, drinks and beverages.

Reopening schedule 2021

England

Guidance – link

Letter from Minister – link

Step 1 (29 March):

- Rule of 6 or two households can meet outdoors but pubs will remain closed.

Step 2 (no earlier than 12 April):

- Pubs can open for outdoor service

- No requirements for a substantial meal to be served alongside alcoholic drinks

- No curfew

- Requirement to order, east and drink while seated (‘table service’) will remain

- Rule of 6 or two households will also remain.

Rules at step 2

Rule of six/two households

For customers sitting in outdoor areas at hospitality settings, the rule of six or two household rule must be adhered to.

Social distancing

Pub staff should maintain social distancing guidelines wherever possible and outdoor seating and tables should be reconfigured to meet the guidelines (two metres or one-metre plus with risk mitigation where two metres is not possible). Members of the group of 6 or two households do not need to be socially distanced. The rules refer to distance between tables, not customers.

Indoor payments

Customers can pay inside for venues serving customers outside, but only as a last resort, such as where portable card payment or cash is not an option. Trips inside should be minimised and if you can run ‘tabs’ for a table rather than paying round by round, you should do so.

Test & Trace

Test & Trace details must be recorded for all customers visiting your premises (not just the person who made the booking).

Venues must display the NHS QR code poster (which can be created here) alongside asking every customer of visitor aged over 16 to check in to the venue or provide their contact details, which can be done using the NHS Covid-19 app. An alternative (paper) method should also be available.

Information collected must include the customer’s name, contact telephone number or email address or postal address, date of visit, time of visit and where possible, departure time – and must not be used for any other purpose other than for NHS Test and Trace unless operators would already collect it for another business purpose.

Outdoor structures

When it comes to external structures, to be considered ‘outdoors’, shelters, marquees and other types of coverings like this can have a roof but need to have at least half (50%) of the area of the walls open at all times while in use.

Face coverings

Customers do not need to wear a face covering when seated outside, but are expected to wear a face covering before entering indoor settings, which includes using the toilet or making a payment – if circumstances require payment to be made indoors.

By law, all businesses must remind customers and staff to wear a face covering where required (such as on posters or providing verbal reminders).

Live music outdoors

Pubs are allowed to host live music outside but it cannot be the main reason customers visiting and cannot be a ticketed Live event.

Takeaway alcohol

The guidance also states from step two (no earlier than Monday 12 April), hospitality venues will be permitted to provide takeaway alcohol. This should be served through a hatch or collected from outdoors.

Toilets

Customers will be permitted to use toilets, baby changing rooms or breast-feeding rooms inside but must wear a face covering when going indoors.

Step 3 (no earlier than 17 May):

- Pubs allowed to reopen indoors

- No requirements for a substantial meal to be served alongside alcoholic drinks

- No curfew

- Requirement to order, east and drink while seated (‘table service’) will remain

- Rule of 6 or two households will also remain (although this is subject to review).

Step 4 (no earlier than 21 June):

- All limits on social contact to be removed

- Larger events to be permitted.

Scotland

From 26 April:

- outdoor hospitality to open till 10pm with alcohol permitted. Indoor hospitality permitted without alcohol and closing at 8pm

- social mixing in indoor public places will be subject to current maximum of 4 people from up to 2 households

More info here:

https://www.gov.scot/news/timetable-for-further-lockdown-easing/

On 17 May:

- Further re-opening of hospitality: bars, pubs, restaurants and cafes can stay open until 10.30pm indoors with alcohol permitted and 2 hour time-limited slots and until 10pm outdoors with alcohol permitted

Early June:

- Hospitality can remain open until 11pm

- up to 6 people from up to 3 households can socialise indoors in a home or public place

- up to 8 people from 3 households can socialise outdoors.

Wales

26 April:

Pubs, bars and restaurants in Wales can reopen and serve alcohol and food outdoors.

More information – https://gov.wales/outdoor-hospitality-given-go-ahead-reopen-and-rules-mixing-outdoors-relaxed-wales

Northern Ireland

Stage 2:

- Six people from two households can meet in private garden

- Reopening of cafes

Stage 3

- Six people from two households can meet indoors

- Table service allowed in restaurants and pubs

- Wet pubs to remain closed

Stage 4

- Wet pubs to reopen with table service

Prepare for the Future

- Bar service in pubs permitted

January 2021 lockdown

| 2021 lockdown | England | Wales | Mainland Scotland | NI |

| Pubs and taprooms | Closed. Food and non-alcoholic drinks allowed for takeaway, click and collect and drive through until 11pm

Alcohol can only be delivered |

Closed except for takeaway and delivery between 6am-10pm. | Closed. Takeaway can operate as normal for off the premises consumption | Closed except for takeaway, drive through or delivery. Takeaway services must close at 11pm and off sales must stop at 8pm. |

| Brewery shops | Can remain open for takeaway, click and collect, drive through and deliveries | Can remain open for takeaway, click and collect, drive through and deliveries | Can remain open for takeaway, click and collect, drive through and deliveries | Can remain open for takeaway, click and collect, drive through and deliveries, must stop after 8pm. |

| Bottle shops | Can remain open for takeaway, click and collect, drive through and deliveries | Can remain open for takeaway, click and collect, drive through and deliveries | Can remain open for takeaway, click and collect, drive through and deliveries | Can remain open for takeaway, click and collect, drive through and deliveries, must stop after 8pm. |

England lockdown

From 6 January 2021 onwards

-

-

- Pubs and bars must close. They can provide food and non-alcoholic drinks for takeaway until 11pm, click and collect and drive-through but not alcohol. Food and all drinks (including beer) can be provided by delivery.

- Off licences and licensed shops selling alcohol (including breweries) can remain open.

-

Government guidance – https://assets.publishing.service.gov.uk/government/uploads/system/uploads/attachment_data/file/949536/NationalLockdownGuidance.pdf

Winter 2020 restrictions

SIBA guidance here.

England Tier System

From 2 December 2020 – 5 January 2021

Government Guidance – https://www.gov.uk/guidance/working-safely-during-coronavirus-covid-19/restaurants-offering-takeaway-or-delivery

Tier 4 guidance – https://www.gov.uk/guidance/tier-4-stay-at-home

| Pubs & Taprooms | Tier 1 | Tier 2 | Tier 3 | Tier 4 |

| Opening restrictions | Open, but table service only. Must be closed 11pm-5am. Last orders at 10pm, customers must leave premises by 11pm. | Closed, unless operating as a restaurant. Alcohol must be served with a substantial meal. You can enter a contracting arrangement to serve food but customers are not allowed to bring their own food onto the premises. Table service only. Must be closed 11pm-5am. Last orders at 10pm, customers must leave premises by 11pm. | Closed – takeaway only. | Closed – takeaway only. |

| Numbers indoors | Rule of 6 applies. | Can only sit inside with members of your household or support bubble. | Pubs closed – no customers indoors. | Pubs closed – no customers indoors. |

| Numbers outdoors | Rule of 6 applies. | Rule of 6 applies. | You cannot allow customers to sit outdoors within your premises to consume ‘takeaway’ beers. Rule of 6 only in some outdoor public spaces such as parks. | You cannot allow customers to sit outdoors within your premises to consume ‘takeaway’ beers. You can only meet one other person outside your household in a public space. |

| Takeaway before 11pm | Takeaway allowed. Customers can collect from inside the premises. No pre order, click and collect or drive through required. Pubs can deliver to customers’ homes. | Takeaway allowed. Customers can collect from inside the premises. No-pre order, click and collect or drive through required. Pubs can deliver to customers’ homes. | Takeaway allowed. Customers can collect from inside the premises. No-pre order, click and collect or drive through required. Pubs can deliver to customers’ homes. | Takeaway allowed. Customers can collect from inside the premises. No-pre order, click and collect or drive through required. Pubs can deliver to customers’ homes. |

| Takeaway after 11pm | After 11pm you can only provide delivery service, click and collect or drive through for takeaway. Pre-orders must be taken. | After 11pm you can only provide delivery service, click and collect or drive through for takeaway. Pre-orders must be taken. | After 11pm you can only provide delivery service, click and collect or drive through for takeaway. Pre-orders must be taken. | After 11pm you can only provide delivery service, click and collect or drive through for takeaway. Pre-orders must be taken. |

Northern Ireland circuit breaker

26 December for six weeks:

-

-

- Pubs must remain closed with the exception of providing food and drink for takeaway, drive-through or delivery.

- Takeaway services must close at 11pm and off-sales must stop at 8pm.

-

Scotland temporary lockdown

From 5 January 2021

-

-

- Pubs are closed but takeaways can still operate as normal.

-

Scotland 5 tiers

2 November 2020 – 4 January 2021

Guidance – https://www.gov.scot/publications/coronavirus-covid-19-protection-levels/pages/protection-level-4/

Level 0 – indoor meetings allowed (8 people, 3 households), outdoor meetings allowed (15 people, 5 households)

Level 1 – 6 people, 2 households meet indoors and outdoors

Level 2 – no indoor, 6 people, 2 households outdoors, pubs permitted to sell alcohol with main meal

Level 3 – alcohol sales not permitted indoors or outdoors, restaurants under strict conditions

Level 4 – non-essential shops closed

Level finder – here

| Pubs/ taprooms | Level 0 | Level 1 | Level 2 | Level 3 | Level 4 |

| Opening restrictions | Open, table service is compulsory | Open, table service only, last entry 9.30pm and close at 10.30pm | Indoors: Open, table service only, alcoholic drinks only with a main meal. Last entry 7pm, close by 8pm. Outdoors: for consumption of food and drinks, last entry 9.30pm, closed 10.30pm. A meal is not required for alcoholic drinks. | Open for food and non-alcoholic drinks. Alcohol cannot be served. Last entry 5pm, closed 6pm. | Closed – takeaway only |

| Numbers indoors | 8 people, 3 households (children under 12 do not count) | 6 people, 2 households (children under 12 do not count) | 6 people, 2 households (children under 12 do not count) | 6 people, 2 households (children under 12 do not count) | Pubs closed – no customers indoors. |

| Numbers outdoors | 15 people, 5 separate households (children under 12 do not count) | 8 people, 3 households children under 12 do not count) | 6 people, 2 households (children under 12 do not count) | 6 people, 2 households (children under 12 do not count) | Pubs closed – no customers outdoors. |

| Takeaway | Takeaway can operate as normal for off the premises consumption | Takeaway can operate as normal for off the premises consumption | Takeaway can operate as normal for off the premises consumption | Takeaway can operate as normal for off the premises consumption | Takeaway can operate as normal for off the premises consumption |

Wales lockdown

Starts: 19 December

-

-

- In Level 4

- Hospitality closed except for takeaway and delivery

-

Guidance for pubs and hospitality sector

See all the guidance and rules for pubs and the hospitality sector including risk assessments and checklists.

Tools for Breweries

Please see our Tools for Breweries page to access template letter for brewery staff and a risk assessment template.

Financial Support

The Government has announced a series of measures to assist small businesses. For the latest please see our Financial Support page.

Flexibility on Destruction of Beer in Pub Cellars

For the latest guidance on the destruction of beer during the Covid-19 crisis, see our separate page.

Crime Prevention Advice

If you’re brewery is closing during the COVID-19 outbreak, there is some good advice on safety and crime prevention for empty commercial property:

Safer Business Network: Advice to closed businesses Click here to read

Met Police: Crime Prevention advice for empty commercial premises

Click here to read

Plus further useful safety resources can be found here:

https://www.saferbusiness.org.uk/covid-19-portal

Exporting Guidance

The Government has published advice for businesses trading internationally which can be found here. The Department for International Trade can provide assistance with customs authorities and supply chain issues.

Mental health

Advice and information on how to look after your mental health and wellbeing during the Covid-19 outbreak. NHS advice – https://www.nhs.uk/oneyou/every-mind-matters/

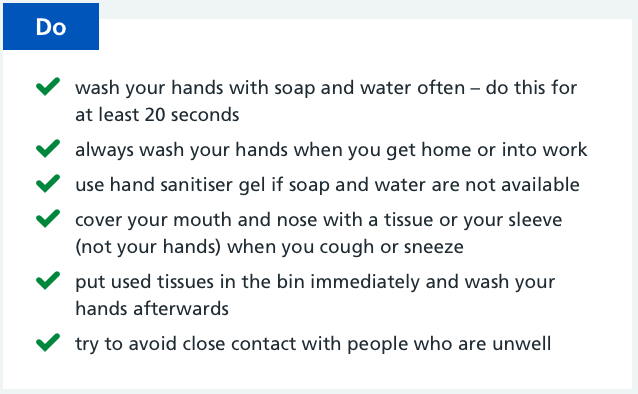

NHS Advice on Coronavirus

Please click here to read the latest NHS advice on limiting the spread of Coronavirus, what symptoms those who have contracted the virus may exhibit and what to do if you believe you may be at risk of having caught the virus, or are showing similar symptoms.